12/6/2023 - Information letters

Charitable foundations under Liechtenstein law

Liechtenstein is increasingly recognised as an excellent philanthropy location

According to a comparison of countries from 2022, Liechtenstein offers the best location worldwide for charitable foundations and philanthropic commitment. This is the result of the Global Philanthropy Environment Index of the University of Indiana in the USA: in a comparison of 91 countries, Liechtenstein takes first place, even before Norway, Switzerland, Germany, and the USA. Accordingly, the popularity of charitable foundations under Liechtenstein law is growing.

Both authors of this article have been working as advisors and foundation council members for several such foundations for many years. Being employees of Allgemeines Treuunternehmen (ATU) in Vaduz, they also know the topic from a different perspective, given that the founder of ATU transferred the company as long ago as in the 1950s to an exclusively charitable foundation, the “Stiftung Fürstlicher Kommerzienrat Guido Feger” (www.guido-feger-stiftung.li).

As a holding foundation, this foundation has become one of the important players in social, charitable, and cultural matters in the tri-border area of Switzerland / Austria / Liechtenstein.

Basis and significance

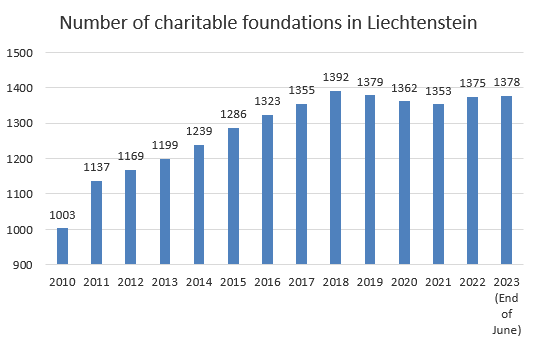

Since 1926, the Personen- und Gesellschaftsrecht (PGR, Persons and Companies Act) has formed the legal basis of Liechtenstein foundations. After the large-scale foundation reform entered into force in 2009, the total number of charitable foundations in Liechtenstein increased steadily until 2018, namely from 1'103 to 1'392. Following a slight decline until 2021, the trend has been on the increase once again. At the end of June 2023, a total of 1'378 charitable foundations were registered with the Liechtenstein Foundation Supervisory Authority (STIFA). If one takes into account that in Switzerland, a much larger country, only ten times as many charitable foundations are registered, one starts to realise the significance of the total number of such foundations in Liechtenstein and the pulling power of Liechtenstein as a location for foundations. This power results from the interplay of a number of factors, which we will outline below.

Liberal attitude of the legislator

Liechtenstein foundation law is characterised by the liberal attitude of the Liechtenstein legislator. This is to ensure that the founder’s intentions can be implemented as faithfully and unimpededly as possible.

This attitude is apparent in several aspects. For example, Liechtenstein law does not set any restrictions to the geographic field of activity of Liechtenstein charitable foundations. Even if a foundation is exempt from taxation in Liechtenstein, there is no rule whatsoever that any specific part of the distributions must remain within the country, as is sometimes demanded in other jurisdictions.

In the context of the supervision of charitable foundations, the liberal attitude becomes apparent in the fact that the legislator relies on the principle that it is the conformity of the foundation council’s actions with the law and with the foundation’s statutes that is to be examined. This supervision of legality is in contrast to a growing tendency abroad to have the supervisory body examine the appropriateness of decisions.

The prohibition of self-serving foundations in Liechtenstein leads to a duty of charitable foundations to act with effect towards the outside as a matter of principle. This means that the distributions must exceed the costs. There are no specific rules as to the relation between costs and distributions beyond that, nor are there any detailed distribution quotas. This is perceived as a locational advantage in comparison to other jurisdictions, whose more detailed rules often restrict the ability to do justice to the colourful variability of reality.

Generally, existing charitable foundations may be moved to or away from Liechtenstein as far as a comparable regime of supervision can be demonstrated. Accordingly, it happens time and again that existing charitable foundations are moved from abroad to Liechtenstein.

Tax exemption

In Liechtenstein, charitable foundations can be exempted from taxation on application. For this to happen, foundations must prove that in addition to meeting the requirement of charitability pursuant to Art. 107 para. 4a PGR, the charitable purpose is pursued exclusively and irrevocably. According to the latest available figures from the end of 2019, a total of 1'192 charitable foundations out of the 1'379 registered at the time were exempt from taxation, which is 86%.

Double taxation agreement Liechtenstein-Switzerland

Even if the majority of charitable Liechtenstein foundations is exempt from taxation, the double taxation agreement between Liechtenstein and Switzerland (DTA LI/CH) adds some aspects that contribute to the attractiveness of Liechtenstein as a location for foundations.

It frequently happens in the environment of the Swiss franc region that charitable legal entities invest in Swiss public limited companies quoted at stock exchanges. In Switzerland, a very high withholding tax of 35% is raised on dividend payments. It is expressly noted in the DTA LI/CH that tax-exempt charitable organisations – which includes foundations – may take advantage of the double taxation agreement regardless of the fact that their income may be exempt from taxation. Specifically, this means that the withholding tax on dividend payments may on application to the Swiss Tax Administration be reduced from 35% to 15%. In the case of substantial assets with a corresponding exposure to the Swiss share market, this will quickly sum up to a saving of several thousand francs per year.

As far as the fees of Swiss citizens working as foundation council members of Liechtenstein foundations are concerned, it is laid down in the DTA LI/CH that these fees are subject to a final tax of 12% at the location of the foundation. This means that after these fees have been taxed in Liechtenstein, they will not be taxed again at the place of residence of the Swiss foundation council member.

Charitable foundation as protected cell company (PCC)

By introducing what is called the “segmented legal entity” (SV) or “protected cell company” (PCC) on 1 January 2015, the Liechtenstein legal system was extended by another option to engage in philanthropical activities. The PCC is not a new form of legal entity but rather a new manner of organisation under company law that can be applied to already existing legal entities. In other words: the PCC is a way of structuring for instance a foundation under company law, and not a new legal form for companies. As an example, this makes it possible to create an umbrella organisation for the pursuit of charitable purposes.

As a segmented legal entity, the foundation consists of a core element and one or more segments. The assets of the individual segments are separated – and remain separate – from each other and from the assets of the core. Each of the segments is subjected to a field of activity or a purpose laid down in more detail in the foundation documents. Thus, one segment may be dedicated to environmental protection, another to the pursuit of social purposes etc. Each segment is assigned specific assets to achieve its purpose.

This new way of structuring a charitable foundation can be recommended to save costs, for example. The financial expenses for formation and for day-to-day administration are far less than they would be

in the case of forming an autonomous foundation for each part segment. In addition, liability is segregated between the segments, which may be advantageous in individual cases.

Over the last few years, several large trust companies in Liechtenstein have formed their own charitable PCCs. These are umbrella organisations for the pursuit of charitable purposes. Allgemeines Treuunternehmen (ATU) formed “Gemeinnützige ATU Stiftung SV” on the occasion of the company’s 90th anniversary in 2019. It serves patrons who are unable or not willing to provide an autonomous foundation for their charitable commitment. They insert themselves into the existing umbrella foundation in the form of a segment.

Public relations work

In the context of the revised foundation law entering into force, the charitable foundations sector also reorganised itself and has since then made a more public appearance in Liechtenstein and abroad. Over the last decade, the “Association of Liechtenstein Charitable Foundations and Trusts” (VLGST), which was established in 2010, has developed into a substantial player for the Liechtenstein charitable foundations sector. The VLGST now has more than 110 member foundations, to which it offers a platform for internal and external networking, cooperation, and exchange.

If you require any further information, please do not hesitate to contact the authors of this article, lic. iur. Märten Geiger LL.M. (Brügge and Vaduz) and Dr. iur. HSG Peter Prast MBA (Chicago), TEP or your client advisor.

PDF download