1/12/2024 - Information letters

ATU Charity Foundation PCC

ATU Charity Foundation PCC was established in 2019 by Allgemeines Treuunternehmen (ATU) on the occa-sion of its 90th anniversary.

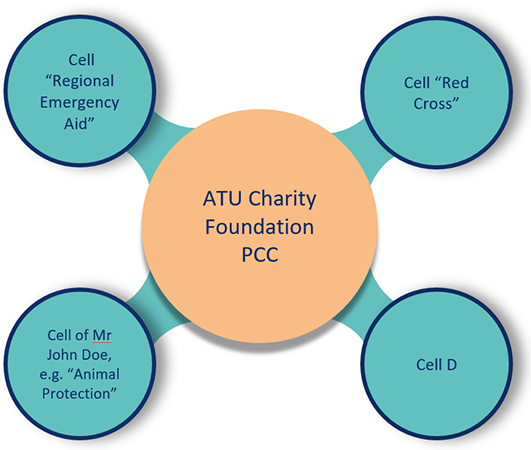

This structure constitutes an umbrella organization for the pursuit of charitable purposes. As such, it serves patrons who do not wish to set up their own foundation for their charitable giving, but prefer to join an already existing umbrella foundation by means of opening a cell.

With this structure, ATU now offers the possibility to support charitable projects in a cost-efficient manner. Already with assets of around CHF 100,000.00, a corresponding segment can be opened in said foundation.

ATU Charity Foundation PCC is a foundation under Liechtenstein law and, as a charitable foundation, is placed under the supervision of the Liechtenstein Foundation Supervisory Authority (STIFA). The foundation is tax-exempt.

Dates and facts

Date of establishment: 31 October 2019

Register number: FL-0002.622.721-1

Foundation Council

- Hansjörg Wehrle, President of the Foundation Council

- Märten Geiger

- Dr. Beat Graf

Auditors

As a charitable foundation, the ATU Charitable Foundation SV is subject to audit by a qualified and indepen-dent auditor. The auditor is appointed by the court and, as an organ of the foundation, the auditor is obliged to review once a year whether the foundation's assets are managed and used in accordance with its purposes. The auditor reports directly to the Liechtenstein Foundation Supervisory Authority (STIFA).

Purpose

The purpose of the Foundation lies in the promotion of the general public, in particular by granting economic support to natural and legal persons, institutions and organizations, pursuing activities in the support of charitable, religious, humanitarian, scientific, cultural, moral, social, sporting or ecological causes or dedicating their activities to the protection of animals.

To achieve its purpose, the Foundation, by resolution of the Foundation Council, shall establish one or more cells. Each cell is assigned a specific field of activity, which is specified in more detail in a supplementary foundation deed. The fields of activity of the individual cells must not conflict with or contradict the purpose of the Foundation.

The Foundation and all its cells are non-profit and irrevocably and exclusively common-benefit structures.

Donation Receipt

Donations and additional endowments to an existing cell or to a new cell of the tax-exempt ATU Charity Foundation PCC are deductible from taxes in accordance with Art. 47 (3) (h) of the Tax Act (SteG). Upon request, a donation receipt will be issued.

Practical Example

Mr John Doe is 80 years old. He has CHF 100,000.00 which he wants to use for common-benefit purposes.

In the years to come, he wants to support the small animal shelter in the community where he lives with the annual amount of CHF 5,000.00. He envisages the possibility of granting support also to other common-benefit projects for the benefit and/or protection of animals.

During his lifetime, he wants to be the one to make the decision both on the granted amount and on the supported projects and he also wants to keep granting support to them. Later, after his demise, he wants his commitment to be continued according to his wishes until the funds are completely depleted.

The animal shelter shall receive a regular grant, distributed over the course of several years, and not too much money at once. In addition, Mr John Doe may support another project that he also deems important.

In such a case or in cases of a similar kind, it is not advisable to create a separate structure for reasons of cost. The formation fees and the administration costs would be too high and a majority of the available funds would have to be used.

An additional endowment to an already existing cell or the creation of a separate cell could save costs and the funds could be used for common-benefit purposes.

Contact

Allgemeines Treuunternehmen

Hansjörg Wehrle, LL.M.

Member of the Board of Trustees

Aeulestrasse 5

P.O. Box 83

9490 Vaduz

Principality of Liechtenstein

T +423 237 34 34

philanthropie@atu.li

If you require any further information, please do not hesitate to contact the author of this article, Angelica Stöckel or your client advisor.

PDF download